Greenify Consulting offers a no-fuss simple to use developer formula for working out whether your land is feasible as a development opportunity for you.

It can be expensive to sub-divide, re-zone or redevelop your land.

WAYS TO MAKE MONEY BY SUBDIVIDING YOUR LAND

“Buying land, dividing it and then selling the parcels is a fantastic way to make big profits fast, and it’s not even as hard as it seems. Larger tracts of land are simply worth less per acre than smaller tracts of land are.

Of course, you need to know a thing or two about the property, the community zoning bylaws and the markets before you can make your huge profit. Armed with the right information and some confidence, you can subdivide your investment property and turn a decent profit in the process.

The quickest way to make a good profit on land is rezoning. Rezoning is the action to change the designation of a subject parcel or group of parcels on the zoning map . The effect of a rezoning is to change the permitted uses for the affected parcels. This means that if one has a huge parcel of land usually utilized for residential purposes, rezoning is required to use it for other purposes – such as commercial use. If one has a residential area which is along the main access road – making it not only dangerous but also noisy to build homes at, the owner can subdivide the property into several smaller properties, and convert these to commercial establishments.

Subdividing land makes it easier to sell because it becomes more affordable to a buyer than a huge track of land. Unless you find a buyer who has something planned for a huge parcel of land – and is actively searching for one – subdividing into several more affordable parts increases the possibility of it being sold much faster. Usually, selling a huge track of land also forces the seller to retail the land for much lower, than selling it in several smaller parts. In fact, the seller may price each parcel differently – depending on land characteristic (if it is sloped, if there are trees, if there is a stream running along one part) of each subdivided part.

Rent /Lease – The owner of a big parcel of land may end up earning much more from the renting out or leasing out of a land subdivided into several individual leasable parts than from a huge single parcel of land to one renter/lessee. Each subdivided part may be charged a different rate depending on what type of improvement or business they intend to put up on it. For example, if a lessee decides to construct a small building from which he/she will also earn, the land owner can charge higher rent compared to the adjacent parts. Leasing / renting out several small parcels of land may turn out more profitable in the long run – because the income stream does not end – unlike selling where once the land is paid for, then that is the end of the profit stream. Not only that – the land is still owned by the lessor.

A newly created piece of land/s reduces your loan, or you can be like most other savvy property gurus who hold on and add value to the property by registering the new lots and holding on to the “new” subdivided parts or further developing them. In its development, you may choose a different purpose for each part of the subdivided lot. Re-registering them into several new titles increases the value of any old property. Also, the owner can divide land then postpone selling until the land prices increase. Subdivision is a great development strategy for the current market conditions. It gives you flexibility to play it safe and sell off.”

TIPS WHEN DEVELOPING UNITS (APARTMENTS) ON YOUR LAND

“Subdivision of existing buildings is the conversion of a single title to multiple titles. For instance, a block of 10 units on a single title –often referred to as units “in one line” – can be converted into individual titles such a strata title. Strata subdivision means dividing a property into separate units, apartments or villas. Strata is a land title based on the horizontal division of air space and may involve common areas shared by each title holder and usually managed by a strata manager.

Subdivision is a great development strategy for the current market conditions. This is a great way to add value to the properties and allows you to sell them off individually. It gives you flexibility to play it safe and sell off a newly created piece of land to reduce your loan, or to hold and add value to the property by registering the new lots and holding or further developing them.

Many would-be property developers don’t even get started because they don’t know where to start. If you want to get involved in the development of new townhouses or apartments, then a great place to start is understanding the process.

Here are 5 tips which you need to take to heart in order to make the most out of your development:

1. Have a development team and finances ready

Here you look for a block of land with potential for development. At this stage you should already have your finance in place so that you know your limits.

You should also have a team of consultants organised who can advise you as to the project’s viability. These should include a development manager who can coordinate the whole process or individually, a solicitor, an architect, a surveyor, a town planner, an engineer and an estate agent to advise honestly on end values and marketability.

2. The figures

Make sure you discuss your subdivision strategy with an accountant and understand the possible tax and GST implications if you are planning to sell. You will also need to estimate your holding costs such as interest on your loan and rates. This can be a real drain on finances if the process drags out and you are not getting any income from the land to help offset your holding costs – so time is money in this type of development. Try negotiating long settlement periods from the vendor or buy under an option.

3. Get a surveyor

Getting a surveyor to manage your subdivision can save you a lot of time. If you’re researching a new area, the first place to start would be the local surveyor. They can give you advice on the subdivision process and cost indications. You need to use a surveyor to prepare your subdivision plan.

4. Determine the type of development which is best for your property

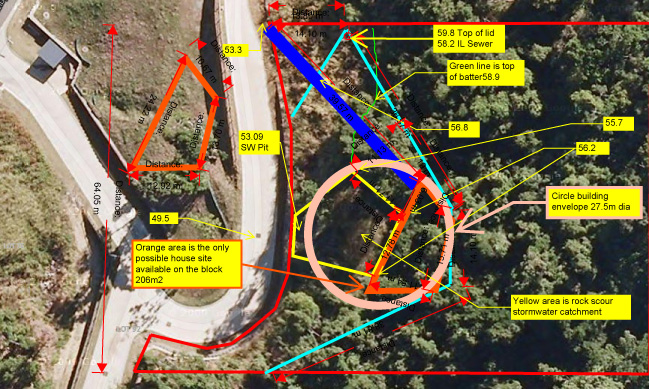

To find out what can be built on the block you need to assess the local council’s policy towards development and see how many new dwellings can be put on the block. This differs from council to council and even within the same municipality.

You also need to assess what the market wants in that particular area – what type of property would sell or lease well. It is important to design and build a project that is marketable – the right size and the right type of dwelling for the demographic that wants to buy or lease in that locality. You can’t usually build any style of dwelling – it has to adhere to set standards within the area – like the number of storeys of an apartment building, especially when the norm in the vicinity are bungalows, or houses with one owner.

5. Construction

Many people think that construction is property development, but it is really just one of the stages. Construction is what a builder does; most developers are not builders. They are a bit like the producer of a movie. They come up with the concept and then orchestrate the entire project. Most developers never really get their hands dirty.

As developer, it is imperative for you to hire a builder/contractor. Obtain quotes from builders and organise finance for the construction phase of the project. How do you pay them? The norm is to pay the builder progressively at the completion of each stage of development – not in lump sum. This stage can last 7-12 months depending on the size of the project.

After your property is completed, then you can have the development refinanced, leased (the preferred option) or sold. While this is the last stage of the development process, it is always advisable to begin with the end in mind – have an exit strategy right at the beginning of the project. This involves having a clear market, with a few already-interested buyers, and sadly – what to do if the project you worked hard at does not drum up the desired number of offers. In which case, it’s time to avail of the services of a real estate agent.”

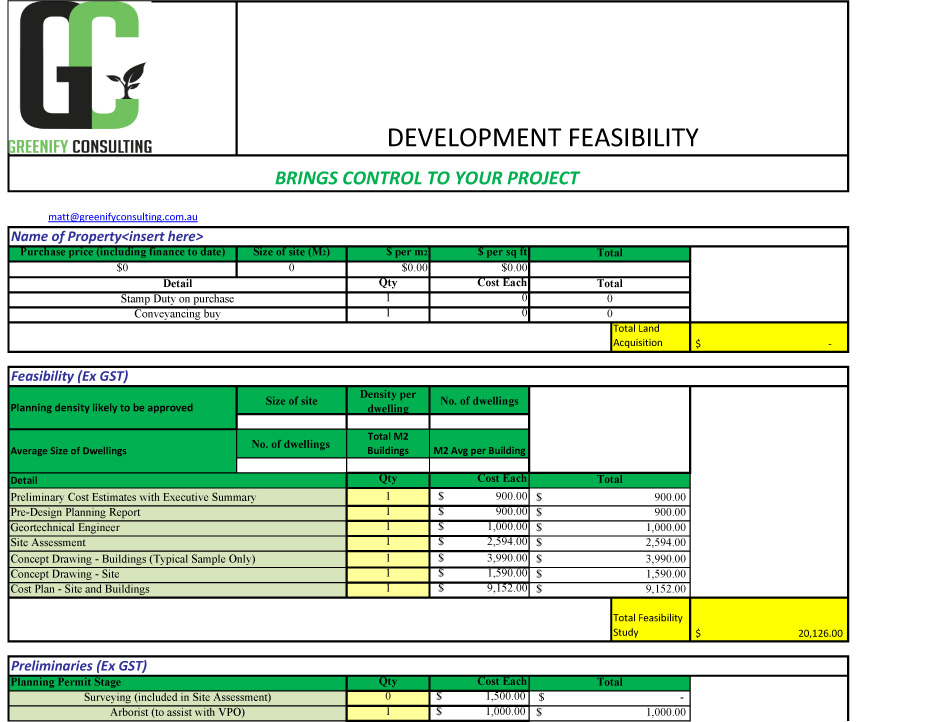

Wouldn’t you like to know if what you were about to do would actually make you money or cost you money. Also determine how long you can afford to sit on the land before you must sell etc etc.

Download Click Here Feasibility Study Template (PDF version)

For a full working version contact me.