Information required to get a Construction Loan:

Information required to get a Construction Loan:

Applying for a Loan – Financial Management

If you think that because you own a block of land or partly own it that the bank going to see this as security for your home loan then you are wrong. The following information is required to get or apply for a construction loan.

Equity in land is not strong security and the banks still see you as a risk to them.

One way in which you can change this is to bundle up a loan for the block of land and home into one. Then you will need a contract with a builder to secure your loan. depending on the bank you can get a loan of up to 60% of the total cost of the loan if you want to owner build.

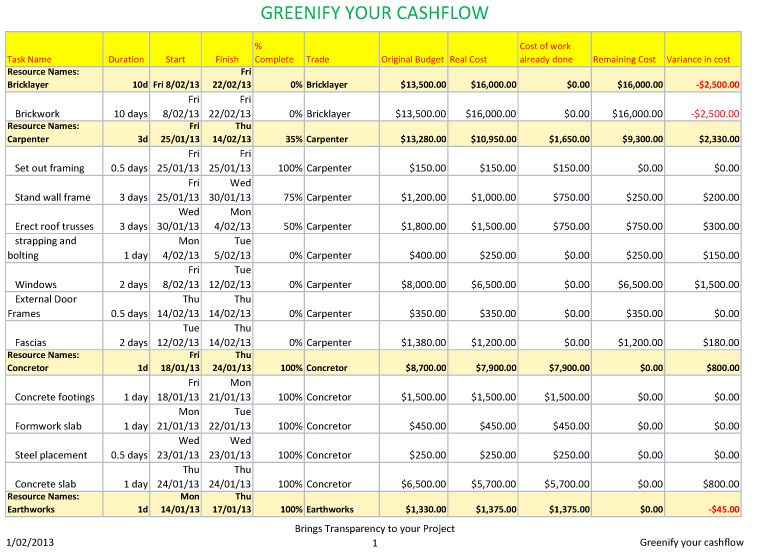

We help owner builders get finance by providing the banks with complete cost transparency and schedules that shows the cost and timing for the home to be built.

The Bank Presentation- Information Required to Get a Construction Loan

Greenify Consulting has helped many clients provide the necessary information required to mortgage brokers and lending institutions. Very quickly you will know if you qualify for a loan and for how much.

We provide:

- Preliminary Cost Estimates

- Detailed Cost Estimates

- Cash flow forecasts

- Draw down on loan forecasts

- Detailed Construction Programs and Delivery Schedules

Clients wanting to owner build have been given up to 80% of the cost of the loan to fund their project.

Establishing your Financial Spreadsheets

Greenify Consulting will work with you to fill in the financial spreadsheets. This will give you control over your finances and also give the bank manager confidence in what you are doing.

Managing your cash flow

Greenify Consulting automatically generates cash flow sheets from your program. This way you can keep on top of progress and payments.

Using the tools provided by Greenify Consulting you will be able to apply for periodic draw downs on your loan.

You will also be able to keep track of invoices and payments to all your trades and suppliers.